“Not having enough money for retirement” was the most common financial concern for Americans according to a report from Gallup. Approximately 60% of Americans were very/moderately worried about money for retirement, followed by “not being able to pay for medical costs of a serious illness/accident” (55% very/moderately worried), and then by “not being able to maintain the standard of living you enjoy” (46% very/moderately worried).

Approximately 50% of Americans are “very” or “moderately” worried about three or more (out of seven) money issues that Gallup measures (Gallup’s “Financial Worry Metric”). Worries decrease with age, and–not surprisingly– increase as income decreases: 72% of those making less than $30,000 per year report being very/moderately worried about 3 or more issues, compared to 50% of those making between $30,000 and $74,999, and 29% of those making $75,000 or more.

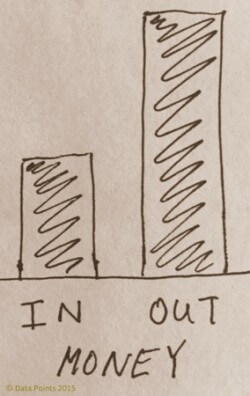

What if they added one more question? One about behavior versus attitude, might help us understand these findings:

On average, what percentage of your net income do you save each year?

If you’re making $150,000 a year but spending $150,000 or more a year, then you would most likely be concerned about all of Gallup’s financial worry areas. Our research suggests–again, maybe not surprisingly– that the relationship between income and worry is much more complex: percentage of income saved, net worth, and other behaviors like planning and monitoring expenses all play a role.