We’ve written before about the often-cited Vanguard “Advisor’s Alpha” study. That research documents the data showing that a good financial advisor can add on average a full 3% in incremental return to a client’s investment portfolio annually. The study then breaks that 3% down into its component parts, showing that the biggest gains–a full 150 basis points–come from effective behavioral coaching that serves to prevent clients from engaging in detrimental investing behaviors (think buying high and selling low). Advisor’s Alpha of an extra 3% per year on portfolio growth!? That’s good stuff. And 1.5% of that is related strictly to behavioral change!? Even with the potential issues related to this type of research, it’s promising in demonstrating advisor value and the effects of behaviors.

But here’s some really really good stuff: our research here at DataPoints reveals that limiting your Advisor’s Alpha target to 3% incremental annual portfolio growth is small potatoes. This data shows that advisors should be mining a potential untapped reserve of an additional 143% in capital addition every single year. What gives? Allow me to explain.

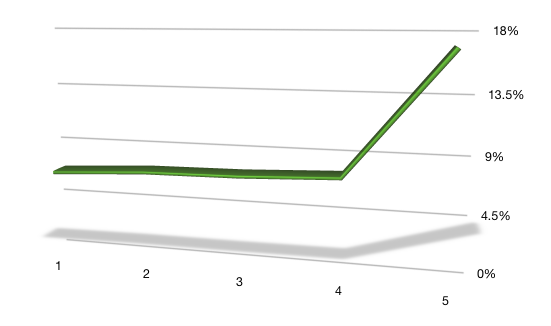

The data that we have gathered over the last four decades regarding wealth accumulation in America and specifically in recent studies reveals that individuals exhibiting certain critical behaviors are able to sock away nearly 2.5x the amount that their peers save each month and year. Specifically, the data shows that “high-potential” individuals (those that exhibit the critical wealth-building behaviors) save on average 17% of their salaries each month, whereas their “low-potential” peers (those that do NOT exhibit these critical wealth-building behaviors) save on average only 7% of their salaries. So the high-potential group is adding an incremental 143% to their capital base every single year. That extra 143% of capital is then subject to the additional 3% annual portfolio growth associated with Vanguard’s calculated Advisor’s Alpha. Over a couple of decades (or a lifetime) that is some powerful math.

Earlier this week University of Chicago economics professor Richard Thaler was awarded the Nobel Prize for his work in the field of behavioral economics. This news serves to bring to the front pages once again the concept that serves as a justification for the work that we do here at DataPoints: people are not purely rational beings–especially when it comes to managing their money and investments. We need tools to gently nudge us in the direction of engaging in healthy economic behaviors, especially when those behaviors are uncomfortable in the short-run but yield big benefits in the long-run.

The DataPoints Building Wealth tool was developed to aid advisors in identifying critical wealth-building behaviors in their clients and potential clients, and to aid in the automation of a process to counsel clients (or as Thaler might say, to “nudge” them) in the direction of constructive behaviors (see Michael Kitces’ review of Building Wealth here). The tool can be used to identify high-potential target clients that may not currently meet asset minimums, and to coach existing clients to improve critical behaviors and incrementally move up the wealth-potential scale.

An advisor’s alpha of 3% in annual incremental portfolio return is great. An advisor’s alpha of an additional 143% added to capital every year is a game-changer for those with healthy incomes and modest net worths.*

*Of course it is mathematically the case that for clients with a current high net worth and low earned income and savings rates, the incremental 3% annual return on portfolio value will be worth more than an increase of 143% in savings rate (especially if the savings rate is currently zero!). But as is the case with a lot of our work here at DataPoints, we’re looking specifically at the group of clients with a healthy income and, well, not-so-high net worth. For this group, a significant increase in annual savings rate (from 7% to 17%) will build wealth more rapidly than marginal increases in annual portfolio returns.

5 thoughts on “Advisor’s Alpha: 3% Is Good. 143% Is Better”

Pingback: Identifying and Guiding Investor Behaviors with the Investor Profile - DataPoints

Pingback: Behavioral Assessments: On The Fintech Map - DataPoints

Pingback: The Commoditization of Portfolio Returns: What's a Financial Advisor To Do? - DataPoints

Pingback: What’s the Difference Between a 17% and 7% Savings Rate? - DataPoints

Pingback: Guest Blog: What’s the Difference Between a 17% and 7% Savings Rate? - Bluewater Financial Planning